重要なお知らせ

- 25/07/14

- 「スキルアップ研究所」に取材記事が掲載されました

| 最安ランキング | 高額ランキング | 週間ランキング | 掘出ランキング | |

|---|---|---|---|---|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 4 |

|

|

|

|

| 5 |

|

|

|

|

不動産競売流通協会とは

-

-

- 不動産競売を扱う不動産会社が加盟する団体として、唯一かつ最大の協会です。全国的結束によって不動産競売の流通を促進しています。

-

東京都の競売サポートはお任せください

- 東京都の戸建

- 3,560,000円

-

- ★★★★☆

- 耐年消化率: 76%

賃貸需要: 25pt/25pt

競売に関するよくあるご質問をご紹介します

-

不動産競売とは、裁判所を通じて不動産を買う事ができる制度です。

不動産を担保にお金を借りた人が返済不能となった場合、対象不動産を差し押さえ、一連の申し立てを受けた裁判所は、少しでも対象の不動産を高く買ってもらえる人へ不動産競売という方法で販売し、売却代金を債務の弁済に充てます。

かつては専門業者でなければ手を出しにくい部分もありましたが、バブル崩壊後に不動産の差し押さえ件数が急増したこともあり、民事執行法の改正がすすみ、どなたでも公正かつ安全に取引ができるようになりました。

市場価格の3割引程度(場合によっては半値以下)で入手できる手軽さから、不動産業者だけではなく一般の方の入札が増えています。

不動産競売は、債権者(お金を貸す人)・債務者(お金を借りた人)・国(裁判所)・買受人のそれぞれが、お互いに助け合って不動産を救済する手段です。 -

●市場価格よりも割安で購入できます。

一般的に競売は中古物件と比較しても3割程度の価格で購入できると言われています。理由としては競売は一般の不動産と変わりませんが、取引の条件など一般の物件と異なる点がある為、価格が安くなっています。

主に占有者との交渉があること、滞納している管理費やリフォーム費用などは買受人が負担することなどがあります。

これらの点を上手に解決することができれば市場価格よりもかなり安く購入することが可能になりますので専門的な知識をもった業者に相談する方が安心といえます。

●公平・簡単な手続きで購入できます。

競売への参加は個人、法人を問わずだれでも入札・購入することができます。

当然競売でマイホームを購入したいと考えている人も入札に参加でき、手続きも思っているより簡単です。

物件に関する情報収集は物件明細書・現状調査報告書・評価書(裁判所物件資料)などで調べることが出来ます。 -

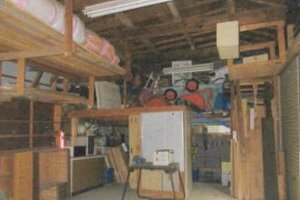

競売購入のリスクには、明け渡されるまで内部を見ることができない、物件調査は短い期間で行わなければならない、落札することが困難、明け渡し時のトラブルなどがあります。

●物件について説明してくれる人がいない

競売の取引は通常の不動産購入と違い物件に関しての説明を受けたり質問したりすることができる仲介業者がいません。

そのため、落札後に現状調査報告書などに記載されていたことと実際の状況が違う場合があった場合でもキャンセルはできません。こうしたリスクを軽減するためにも競売の取り扱いは専門的な知識をもった業者に相談する方が安心といえます。

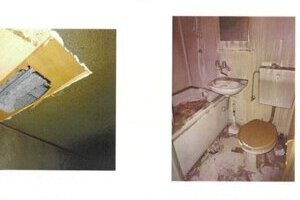

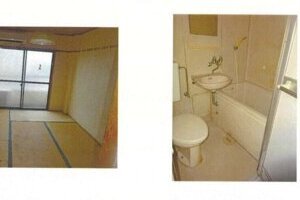

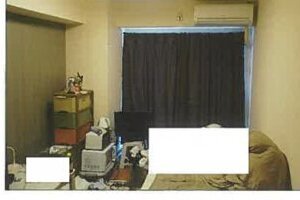

●建物の内部を実際に見ることができない

競売による売却手続きがとられている段階では、占有者がいる場合が多いです。占有者がいる物件は事前に内装や管理状態を確認することは難しいとお考え下さい。ただし建物の外観や周辺環境の確認、近所の方に話を聞くことである程度の情報収集は可能です。また裁判所物件資料には物件の写真・間取図面がありますので、だいたいの確認はできます。

●入札時、残代金支払時に現金が必要

保証金や残代金の支払は一括納付になります。

銀行ローンも利用できますが銀行や申込人によっては、融資を受けられない場合もありますので事前に協会の正会員業者に相談することが大切です。

●明け渡し時の交渉が難しい

物件によっては明け渡し交渉が必要な場合がありますので、トラブルや面倒で困難な作業を避けるためにも競売の取り扱いは専門的な知識をもった業者に相談する方が安心といえます。

●瑕疵(かし)担保責任がない

通常の不動産売買においては瑕疵担保責任を売主に追及することができますが、競売では仮に瑕疵があっても損害賠償を請求したり、契約を解除することはできません。

競売は通常の売買よりも安く購入することが出来ますが、その分リスクもあるとお考えください。

こうしたことから競売の取り扱いは専門的な知識をもった業者に相談する方が安心といえます。 -

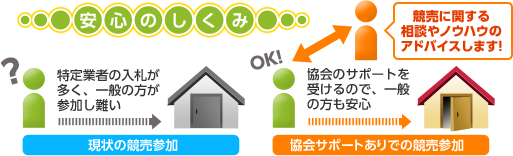

競売への参加は個人、法人を問わずだれでも入札・購入することができます。

競売に関する法律も整備されてきており以前に比べて競売に参加するハードルは下がっています。

ただし物件の調査や入札、落札時の手続きなど平日に裁判所へ行く必要もあります。

また物件により占有者などがいる場合には購入者の責任で立ち退き交渉を行わなければならず、一般の個人の方にとってはハードルが高いと感じる場合があります。

安心して取引するためには専門的な知識をもった業者に相談する方がよいかもしれません。 -

一度入札した権利の放棄はできません。

したがって、落札した場合は事前に支払った保証金は没収されます。

入札前は、しっかりした調査と資金繰りの準備をしてから参加しましょう。

-

入札した物件を落札できなかった場合は、納付した保証金は全額返還されますので安心してください。

-

内覧できる物件もありますが、まだ少ないのが現状です。

ほとんどの物件は間取り図面と各部屋の写真から想像することになります。 -

基本的には利用できますが事前に協会の正会員業者に相談することをお勧めします。

尚、銀行や申込人によっては、融資を受けられない場合もありますのでご注意下さい。 -

占有者に対し明渡し交渉ができます。

代金の納付から6か月以内であれば、裁判所に「引渡命令」を出してもらうこともできます。 -

多くの物件は内覧が出来ない場合があります。

裁判所物件資料などで建物の外観や内観を画像で確認することもできますが、あくまでも調査した段階での情報だとお考えください。

調査から時間が経過している物件もあるため現地調査は大切です。 -

過去には立ち退き料を求めてくる「占有屋」と呼ばれていた人がいましたが今では法律が大きく改正され、そのような問題はほとんど起こらなくなっています。

現在の占有者のほとんどは止むを得ない事情で競売にかけられたご家族の方などになります。 -

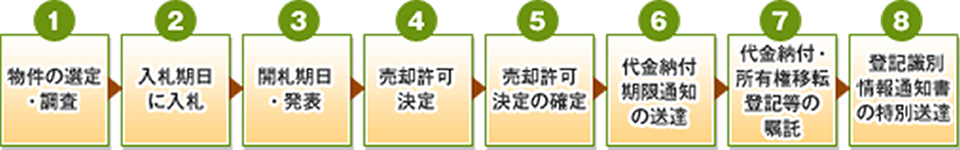

【1】物件の選定・調査

はじめに本サイトからご覧いただける物件情報から、ご希望の条件で物件を探してみてください。

その際には裁判所作成の物件明細書・現況調査報告書・評価書(裁判所物件資料)をご覧いただくことで必要な情報を確認することができます。

【2】入札期日に入札

入札書一式は裁判所執行官室にて入手して、必要書類をそろえて執行官室に提出します。事前に保証金を振込みが必要になりますが、落札できなかった場合は返却されます。落札後に残代金の支払いができなかった場合には保証金は戻らないので、ご注意ください。

【3】開札期日・発表

開札期日には必ずしも入札に立ち会う必要はありません。FAXサービス開札結果を知ることができる場合があるので、事前に裁判所で確認を取りましょう。

【4】売却許可決定

開札期日から1週間後に売却決定期日が定められています。裁判所は問題がなければ「売却許可決定」を言い渡します。裁判所物件資料に売却決定期日が記載されているので、確認しておきましょう。

【5】売却許可決定の確定

売却許可決定より1週間経過後に売却許可決定が確定しますが、その間に執行抗告が出れば確定が延びてしまいます。

執行抗告により手続きが1~2ヶ月中断されてしまいますので、この期間も事前に織り込んで計画をしましょう。

【6】代金納付期限通知の送達

売却許可決定が確定すると、裁判所より『代金納付期限通知書』が届きます。記載された期日までに残代金を支払う必要があります。

【7】代金納付・所有権移転登記等の嘱託

残金と登録免許税等を振込み、必要書類(振込書の控え、住民票(個人)又は資格証明書(法人)、最新の登記簿謄本(全部事項証明書)、評価証明書)を提出して、所有権移転登記の為の手続きをします。

【8】登記識別情報通知書の特別送達

代金納付手続が終了して1~2週間経過すると、裁判所から「登記識別情報通知」あるいは「登記嘱託書副本」という書類が「特別送達」で届きます。これで所有権の移転は完了です。

不動産競売とは?

不動産競売とは?

競売のメリットとは?

競売のメリットとは?

逆に競売のリスクとは?

逆に競売のリスクとは?

だれでも購入することはできるのですか?

だれでも購入することはできるのですか?

入札した後キャンセルできますか?

入札した後キャンセルできますか?

落札できなかった場合、保証金はどうなりますか?

落札できなかった場合、保証金はどうなりますか?

入札する前に建物の中を見る事は出来るのでしょうか?

入札する前に建物の中を見る事は出来るのでしょうか?

住宅ローンは使えるのでしょうか?

住宅ローンは使えるのでしょうか?

居住者がいる場合は?

居住者がいる場合は?

なぜ現地調査をする必要があるのですか?

なぜ現地調査をする必要があるのですか?

占有者はどんな人ですか?

占有者はどんな人ですか?

競売購入までの流れ

競売購入までの流れ