| cheapest | expensive | page views | fewer views | |

|---|---|---|---|---|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 4 |

|

|

|

|

| 5 |

|

|

|

|

Explore court auctions

-

Court auctions of real estate are procedures for the general public to purchase real estate through the courts. When a debtor defaults, the court seizes the collateral property, auctions off the property to the highest bidder, and allocates the proceeds to the creditors.

Foreclosure auctions used to be only for specialized realtors. After the bubble economy, foreclosures increased and the Civil Execution Act was revised to enable the general public to engage in fair and secure transactions. Winning bids may range from about 30% to 50% discount of market prices, so there are more bids from the individual buyers as well as from real estate companies.

A foreclosure auction is a way to redeem the real estate with the creditor, the debtor, the court, and the buyer cooperating with each other.

-

●Prices are lower than the market prices.

Generally auctioned properties are about thirty percent lower in price than even pre-owned non-auctioned properties. Properties themselves are not any different, but the terms and conditions of transactions differ from general transactions, which is a big factor in lowering the price. The fact that a buyer must negotiate with possessors of the acquired property, and that the buyer must bear the costs of service fees in arrears and of refurbishing, are important.

●Procedure is fair and simple.

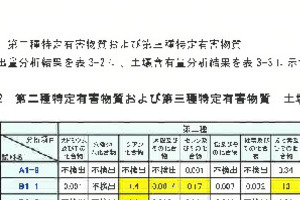

Anybody whether individual or company may bid and purchase a property in the court auction. Homebuyers can also bid. And the process is easier than generally thought. Information regarding the asset may be obtained from the three core court documents about the property, the description, the research report, and the appraisal report. -

Risks associated with court auctions

Risks associated with court auctions

Risks associated with buying foreclosed properties through the court auctions include not being able to see the inside of property until vacated, not having enough time to study the property, not being able to win the bid easily and to take possession of the property easily after acquiring the property.

●Nobody can explain or answer questions about the property.

Unlike in regular acquisition of real estate, in an auction, there are not any agents to explain or answer your questions about the property. Even when you find something about the property actually different from what was described on the research report of the court after winning the bid, you cannot cancel the bid. To mitigate such risks, it would be wise to consult realtors with specialized knowledge about the foreclosure auctions.

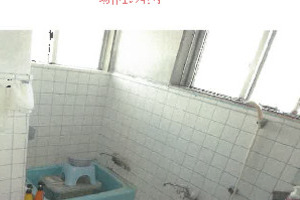

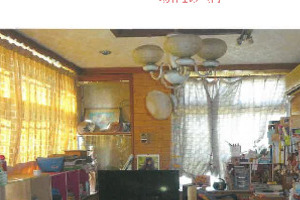

●You can't see the inside of building.

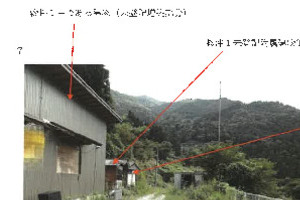

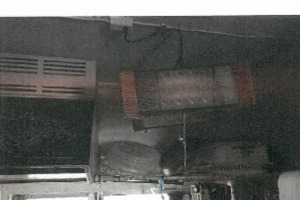

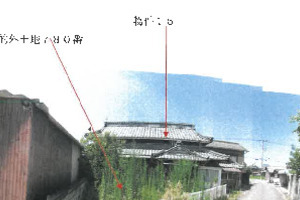

Usually there are people occupying the premise while the auction process moves ahead. And when there are occupants, you generally cannot see the interior or how the property is maintained. You may however check the exterior of the property, the surrounding conditions, or talk to the neighbors. There are also photographs and layout drawings in the Tri-set documents provided by the court, which give you a rough idea.

●You need cash to bid and to buy the property.

Payments for the guarantee, the earnest money deposit, and for the sale must be made each in a lump sum: the guarantee is allocated toward the sale. You may or may not qualify for a bank loan, so it would be wise to consult an FKR agent beforehand.

●Negotiating eviction may be difficult.

In some cases a buyer must negotiate with occupants for evictions, which may be cumbersome and troublesome, so it may be better to consult an agent specialized in auctioned assets.

●No warranty agaist defect

In an ordinary real estate transaction, a buyer may be legally entitled to seek damage or compensation from the seller for defects in the property sold, under certain conditions. In a court auction sale, however, a buyer cannot seek damage nor cancel the sale even when there are defects in the property sold. One way to look at this may be that auctioned properties are priced at discount for the higher risks. -

Anyone whether an individual or a company may bid and buy a property in the court auction. Laws have been revised to lower hurdles to the auctions. Yet a prospective buyer must spend time researching the property, go to the court on weekdays for bidding and other procedures. And the buyer must take responsibility in negotiating evictions, so an average individual may feel it too difficult. For comfort it may be wise to consult a specialized agent.

-

You cannot cancel your bid. Once you win the bid, your guarantee, the earnest money deposit, is automatically applied to the payment; so you cannot get it back. Before you bid, you must thoroughly prepare for the bid, researching and securing the fund.

-

Return of the earnest money deposit

Return of the earnest money deposit

When you lose the bid, you get your entire guarantee deposit back.

-

In few instances you can actually see the inside of property on site. In most cases, however, you can only imagine it from the photographs and layout drawings.

-

Generally a buyer may draw a mortgage loan, but consulting an FKR member broker beforehand is recommended. In some cases, depending on lender and applicant, a loan may not be available.

-

When there are occupants, you must negotiate evictions. Within six months of paying for the sale, you can ask the court to issue the eviction order.

-

You should investigate the property on site. Usually you cannot look inside the property. Even though you can estimate the condition of property from the photographs in the court documents, they are at the time of the court inspection, which may have happened long ago. So it is important to conduct your own on-site research on the property.

-

In the past there were professional possessors who demand fees for moving out. Major revisions to the related law eliminated most of them. Nowadays occupants are ordinary families who for one reason or another had their homes and apartments foreclosed.

-

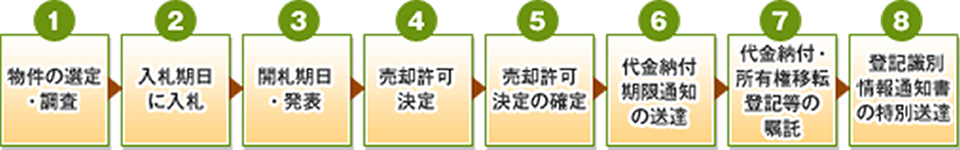

【1】Sifting and researching

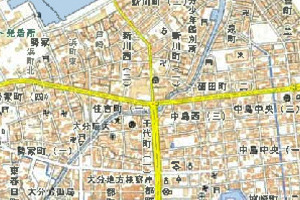

First please select properties that interest you from the 981.jp website. From the three core court documents, description, inspection and evaluation reports, information about properties can be obtained.

【2】Bid on the auction date

Upon obtaining the set of required documents for the bid from the enforcement officer section of the court, and filling them out, you submit them to the enforcement officer. You must pay the guarantee via a bank transfer beforehand. When you lose in the bid, you get the guarantee money back. When you win and fail to pay for the sale, you lose the guarantee and cannot get it back.

【3】Auction result

You need not be there for the bid opening. And you may be able to have the court notify you of the result via facsimile, so you should check with the court.

【4】Sale decision

The court decides on the sale one week after the bid opening, allowing the bid winner to buy the property if it does not find any issues. The document sets indicates the decision date, which you should keep in mind.

【5】Finalizing the decision

One week after the court decision to allow the sale, the decision becomes final, which may be delayed in an event of appeal, for one to two months, which you should include as a contingency in your plan.

【6】Notice of due date for making the payment

After the sale decision is finalized, the court sends the notice of due date for making the payment for the sale. So you must pay the amount before the due date.

【7】Registration

After making the sale payment in full, paying for taxes and fees, preparing the necessary documents which include a copy of bank transfer, a certificate of individual residency or corporate qualification, a copy of the newest and full registration, the evaluation certificate, you submit the documents to register the ownership transfer.

【8】Notice of information to identify registration

After one to two weeks after making the sale payment, the court sends a notice of information to identify registration or a duplicate of entrusting registration on special mail. This concludes the transfer of ownership.

Court auctions of real estate

Court auctions of real estate

Advantages of court auction

Advantages of court auction

Anybody can bid and buy.

Anybody can bid and buy.

Can not cancel a bid

Can not cancel a bid

Can not see the inside

Can not see the inside

Mortgage loan

Mortgage loan

When occupants exist

When occupants exist

Merit of on-site research

Merit of on-site research

Possessors

Possessors

Steps in court auctions

Steps in court auctions