About real estate sold through court auctions

Q&A about court auctions

-

What is real estate auction?→ 読む

What is real estate auction?→ 読む

Through court auctions, one may acquire real estate. When a debtor defaults on payments, the creditor files for the judicial foreclosure of the collateral properties. Courts sell the properties to the highest bidders and allocate the proceeds to the credits.

Foreclosure auctions used to be only for specialized realtors. After the bubble economy, foreclosures increased and the Civil Execution Act was revised to enable the general public to engage in fair and secure transactions.

Winning bids may range from about 30% to 50% discount of market prices, so there are more bids from the individual buyers as well as from real estate companies.

A foreclosure auction is a way to redeem the real estate with the creditor, the debtor, the court, and the buyer cooperating with each other -

What are merits?→ 読む

What are merits?→ 読む

●Prices are lower.

Generally, prices are about 30% lower than in the regular markets; although it depends on the property and the underlying situations. While physically properties are not any different from those on the regular markets, the differences in terms and conditions of transactions and other factors make the prices lower in general. Some of principal factors are that the buyers must often negotiate with existing occupants to evacuate before taking possession of the properties, and that there may be additional costs in forms of liabilities in arrears that the buyers must pay and of required renovations. By skillfully solving these problems, one may acquire a property at much lower cost, so a prospective buyer should consult an agent specializing in these deals.

●Procedure is fair and simple.

Anybody whether individual or corporation can bid and buy a property in court auction. First-time home buyers, for example, may certainly bid in auctions. And the procedure is simpler than one may think. Information about a property may be obtained from the Tri-set court documents consisting of property description, research, and appraisal reports. -

What are risks?→ 読む

What are risks?→ 読む

In buying a property in court auction, there are various risks; such as in an inability to see the inside, need to complete the research in relatively short period, difficulty in winning the bid, and in the eviction and taking the possession.

●Nobody answers about the property.

Unlike in a regular transaction, there aren't any brokers in court auctions. Even when the fact found after buying differed from what was written on the court reserch report, you cannot cancel the sale. To mitigate such risks, it is probably wise to consult an expert agent.

●One cannot see the interior.

Usually there are occupants at the time of court auction process. And with occupants, one may not see the inside of the building or the state of maintenance. One may however check the exterior, the surroundings, and talk to the neighbors. And there are photographs and layout drawings of the building in the Tri-set documents.

●Buyers need cash for payments.

Payments of the earnest money deposit and the sale must be in cash and lump-sum. One may draw a bank loan, but should secure the fund before bidding; experienced agents may help in this respect also.

●Negotiating eviction is difficult.

In some cases, a new owner must negotiate the eviction to take possession. To circumvent troubling and arduous tasks, one may engage professionals for advices.

●No warranty for defecrt

In regular transactions, there is a legal warranty for defect, but not so in court auctions. Even some defects in real estate exist, a buyer cannot seek damage, compensation, nor cancel the sale. In court auctions, prices are generally lower, but risks are higher. -

Can anybody buy a property?→ 読む

Can anybody buy a property?→ 読む

Any individual or company, Japanese or not, may bid in court auction and acquire properties. Legal upgrade has made it easier. But one must conduct researches, visit the courts several times, and take some measures in taking possessions.

-

Can I cancel a bid?→ 読む

Can I cancel a bid?→ 読む

No, you cannot cancel your bid. You lose the earnest money deposit. Thus, a through research is called for before bidding.

-

After losing in the bid, what happens to the deposit?→

読む

After losing in the bid, what happens to the deposit?→

読む

If you lose out on the bid, you will get the entire earnest money deposit back.

-

Can't I see the inside of building before bidding?→

読む

Can't I see the inside of building before bidding?→

読む

In some rare cases, you can. But in most cases, you must use your imagination based on the photographs and layout drawings.

-

Can I draw a mortgage loan?→ 読む

Can I draw a mortgage loan?→ 読む

Generally you can, but we recommend you consult FKR agents beforehand. And some cases a loan is not available.

-

What do I do with occupants?→ 読む

What do I do with occupants?→ 読む

You can talk with them about vacating the premise. Within six months of the payment, you may ask the court to issue an eviction order.

-

Why should I research on site?→ 読む

Why should I research on site?→ 読む

In most buildings, you cannot enter and see the inside. While you can check the photographs on court papers, they are as of the court investigation, which usually was done months before. So it is important to see the property yourself.

-

Who are possessors?→ 読む

Who are possessors?→ 読む

There used to be professional possessors who demand payments for moving out. Improvement in laws eliminated them. Most of possessors nowadays are ordinary people in distress.

-

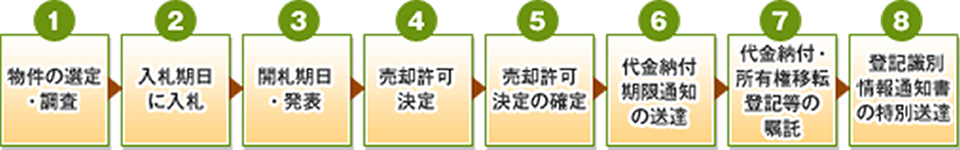

Steps in buying real estate in court auction→ 読む

Steps in buying real estate in court auction→ 読む

I. Select and research

First you look for properties that meet your interests on 981.jp.

II. Bid

Upon obtaining the bid form from the court, you file it along attachments to the enforcement officer. You also need to pay the deposit, which will be returned if you lose in the bid. When you win the bid, however, and unable to pay the remainder of the payment, you lose the deposit.

III. Result

You need not be there for the announcement; with some court you may be notified via fax, so check with the court beforehand.

IV. Court decision

One week after determining the winner, the court delivers a decision to allow the sale to the winner, in absense of any inhibiting issues. The date to decide on the sale is listed on the Tri-set documents.

V. Finalize decision

One week after the decision it becomes final. If an appeal is filed within a week, the decision does not become final, halting the process for up to two months. So a buyer should take account of this contingency.

VI. Notice of payment due

When the sale decision is finalized, the court sends a notice of due date to make the payment. So you must pay the amount before the due date.

VII. Pay and register

The buyer pays for the property and the registration lisence and other taxes and fees, files for the registration of ownership, providing necessary documents such as a copy of bank transfer, residential certificate or qualification certificate, latest copy of poperty registration, and appraisal certificate.

VIII. Court notice

One to two weeks after the payemnt, the court sends a notice for registration identification or registration consignment. This concludes the ownership transfer.